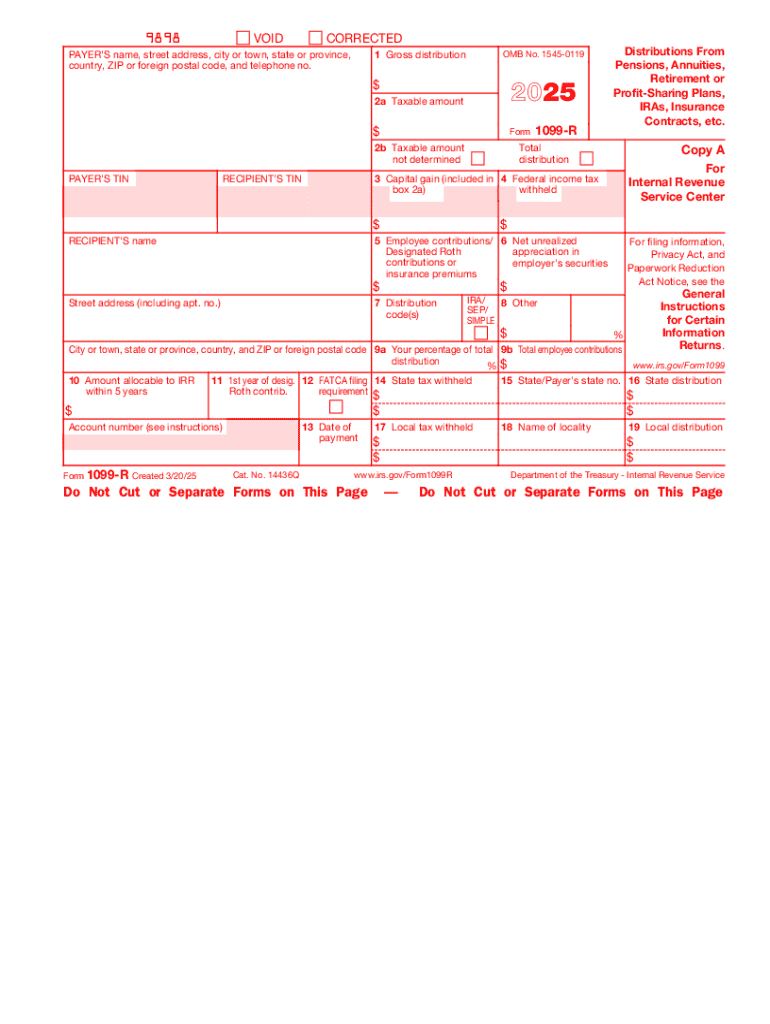

IRS 1099-R 2025-2026 free printable template

Instructions and Help about IRS 1099-R

How to edit IRS 1099-R

How to fill out IRS 1099-R

Latest updates to IRS 1099-R

All You Need to Know About IRS 1099-R

What is IRS 1099-R?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1099-R

What should I do if I notice an error after filing my IRS 1099-R?

If you notice an error after filing, you can correct it by submitting a Form 1099-R with the correct information marked as 'Corrected' at the top of the form. It's important to ensure that the correction is made as soon as possible to avoid complications or penalties related to inaccurate reporting.

How can I verify if my IRS 1099-R has been received by the IRS?

To verify if your IRS 1099-R has been received, you may contact the IRS directly through their customer service line. Additionally, tracking can be done through the e-filing system you used, if applicable, which may provide status updates on submissions.

What should I keep in mind regarding the record retention period for IRS 1099-R?

You should keep IRS 1099-R records for at least three years from the date you filed or the due date of the form, whichever is later. This retention period is essential for supporting your tax filings in case of audits or discrepancies.

How do e-signatures work when submitting IRS 1099-R forms?

E-signatures are acceptable for IRS 1099-R submissions as long as the e-filing system you are using complies with the IRS standards for electronic signatures. Always ensure that your method of e-signature is secure to protect sensitive information.

What should I do if I receive a notice from the IRS regarding my IRS 1099-R?

If you receive a notice from the IRS concerning your IRS 1099-R, carefully read the notice to understand the issue. Gather the relevant documentation and prepare a response addressing the IRS's concerns, and ensure you reply by the deadline specified in the notice.

See what our users say